Summary

Supply chains are constantly evolving, changing companies’ real estate requirements. This is the second installment of a three-part series that delves into the role of logistics real estate within supply chains. In the first paper of the series, we examined the impact of e-commerce and rising service levels on supply chains and logistics real estate. We found that the rise of e-commerce is pulling supply chains closer to consumers, driving up demand for more costly, infill logistics space.

In this paper, we build on these insights to examine a key question: Are these new network strategies sustainable? The answer is yes for two key reasons:

- E-commerce delivers substantial value to consumers. E-commerce has given rise to Synchronized Commerce, where the pick/pay/deliver portion of supply chains is performed by retailers instead of consumers. Efficiency gains, greater variety, and greater convenience are byproducts of this shift.

- Logistics real estate can create value far beyond its cost: Big upgrades in logistics real estate are a small cost in the context of the total supply chain (less than 5% of spend and 25-50 bps of revenue), and yet they can significantly improve service levels and cost management.

Prologis Research partnered with The Sequoia Partnership, a leading supply chain research group, to estimate the total cost of supply chains piece by piece. The result is a new model for evaluating the tradeoffs companies must make in their supply chains to optimize costs and address rising demands on service levels. This model also factors in the growing influence of e-commerce on key components of end-to-end supply chain spend: transportation, labor, retail operations, and logistics real estate.

Based on this analysis, several additional findings emerged that can help future-proof supply chains and logistics operations:

- E-commerce intensifies the focus on distribution center location strategy. Relative to brick-and-mortar, e-fulfilment requires the re-allocation of 75 percent of supply chain costs and prompts an approximate 400 percent increase in spending on distribution centers and transportation to consumers.

- Decentralized e-fulfilment distribution is the most cost-effective model. Total cost of supply is about 15-20% less than self fulfilment in a traditional retail environment. These cost savings are amplified by higher service levels that provide a competitive advantage.

- New methods of e-fulfilment (e.g., click-and-collect) add to logistics demand in the same manner as traditional e-fulfilment, which is 2.5-3 times that of a pure brick-and-mortar retailer.

- Reconfigured supply chains are intensifying the need for labor and creating significant employment opportunities in local communities.

The Only Constant is Change

-

Our first paper in this series looked at overlapping trends driving change for real estate—globalization, data/automation and transportation innovations—and consumer expectations for lower cost, broader variety and faster delivery. These trends prompted three important questions for supply chains and logistics real estate:

We take these three questions in order. This second paper addresses the economics of supply chains and real estate in several ways. First, it takes an end-to-end perspective and considers all costs in supply chains. Second, it highlights and compares the costs and value that different supply chain strategies create, specifically brick and mortar compared with e-commerce. Third, these analyses support the durability of e-commerce fulfilment strategies, particularly decentralized distribution networks, which offer superior value to customers.

Total Cost to Supply: An End-to-End Perspective on Supply Chains

Supply chains add value to goods as they move from where they are produced to where they are consumed. These value chains are constrained by the costs, capabilities and inter-dependencies of their inputs, specifically transportation, labor and real estate.

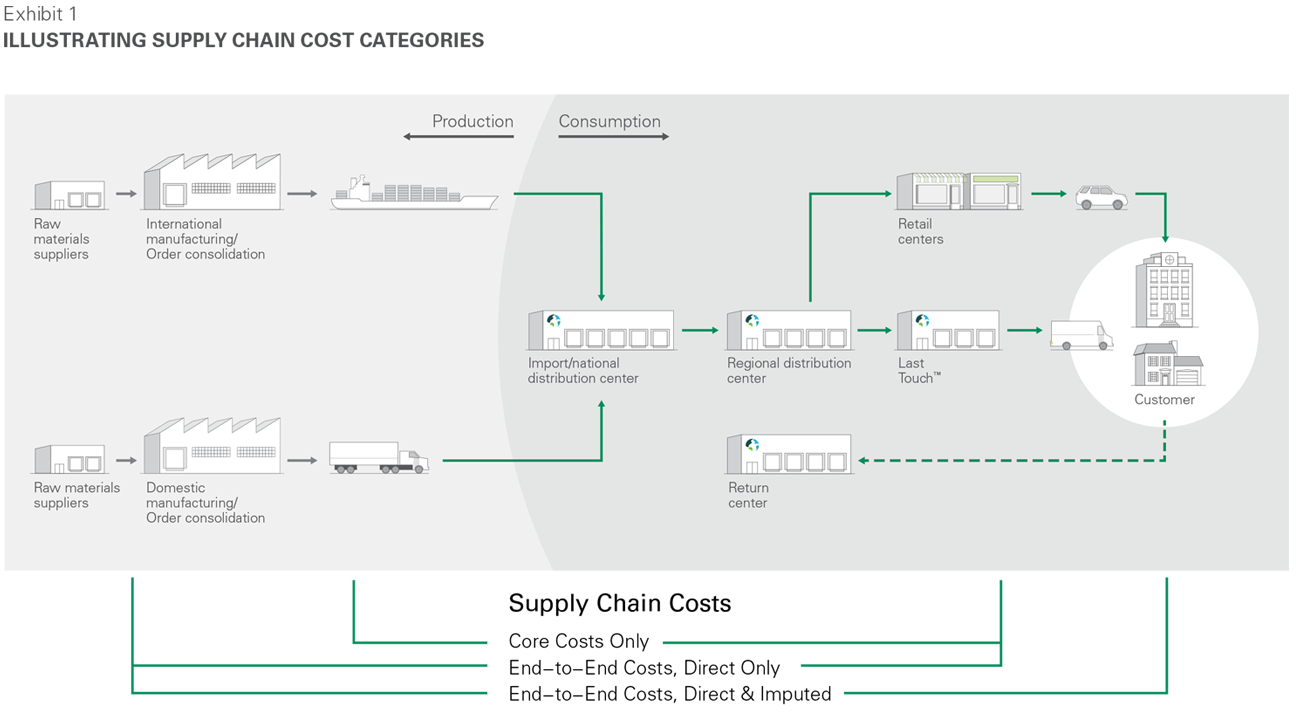

There are three ways to consider supply chain costs:

- Core supply chain costs. Traditional supply chain analyses focus on a portion of the value chain, which we refer to as “core supply chain costs.” These core costs include all costs related to getting goods from ports to stores (brick-and-mortar retail) or into the parcel network (e-commerce).

- End-to-end costs, direct only. A total cost to supply model considers all costs along the full value chain and highlights the beneficial role of logistics real estate. This accounting begins with upstream costs, such as ocean transportation, and extends to costs associated with retail real estate.

- End-to-end costs, direct and imputed. With the rise of e-commerce, supply chains have lengthened all the way to consumers’ doorsteps, so total cost to supply also must consider home delivery, either explicit, in the form of direct-to-consumer delivery, or imputed, in the form of consumers bearing the time burden and cost to obtain their goods from storefronts.

Our total cost to supply model measures cost by type and their positioning along supply chains.

Specific steps include:

- Inbound ocean shipping and port activities, such as fees

- Surface transportation to distribution centers (DCs), which includes the fuel, equipment and drivers to DCs

- All distribution center-related costs, which bring together facility costs, labor and equipment

- Surface transportation from DCs, which brings together the fuel, equipment and labor to transit goods between DCs and stores/consumers

- Retail costs, which includes all store-related costs such as rent and labor

- Consumer time,1 which measures the cost of consumers obtaining goods from retailers and distributors

Synchronized Commerce: process in which the pick/pay/deliver portion of supply chains is performed by retailers instead of consumers.

Our general approach illuminates important commonalities across industries. Supply chains vary widely, and our analysis focused on three categories: general goods, groceries and apparel. Important commonalities exist across each category—core supply chain costs average 5-10% of revenue, and in turn, rent is approximately 5% of supply chain costs (or 25-50 bps of revenues). While there are clear differences beneath the surface—for example, international supply chains (general goods) versus domestic (food), or low- versus high-touch goods (apparel)—relative costs and insights from one industry often extend to others.

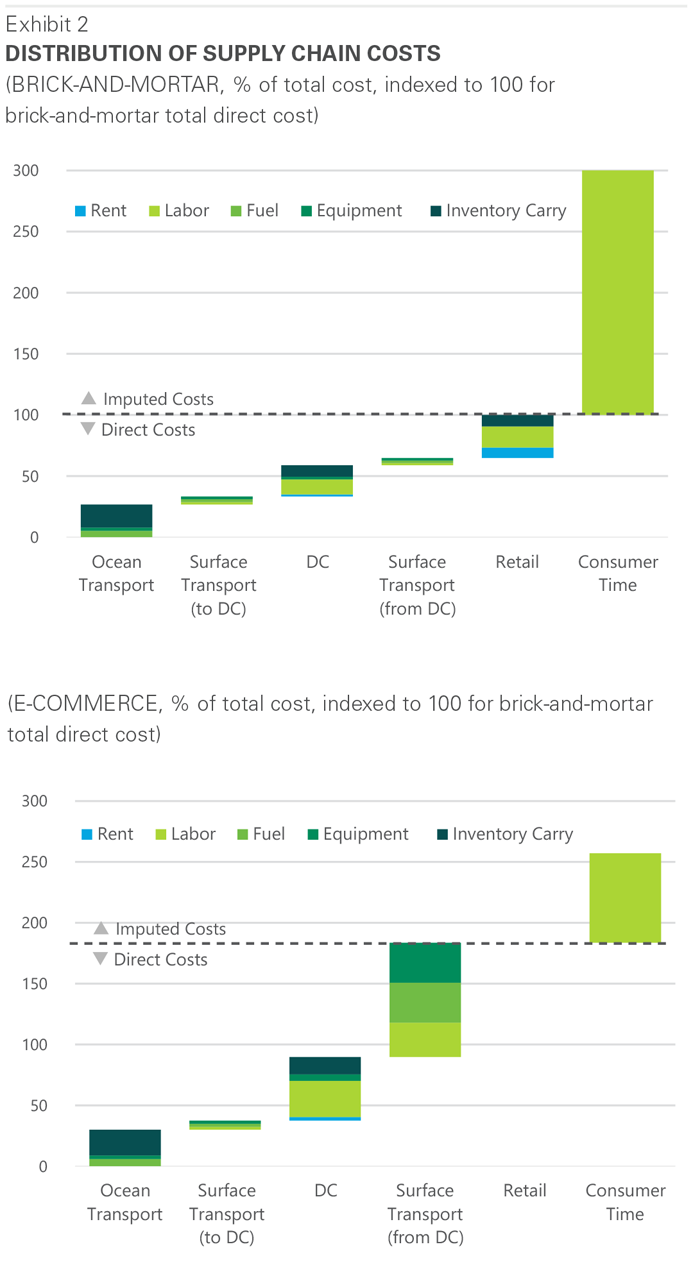

We illustrate the relative tradeoffs in supply chain configuration. We prepared a case study on the organization and costs for general goods distribution. Our model makes assumptions about the types of goods, their sizing and packaging. Find more detail about assumptions in our end note2. In the chart below, we index all costs to the total cost to supply on a direct basis. This reveals the cost retailers currently bear on traditional throughput distribution. It also highlights the cost of consumer time and the value delivered by online retailers through Synchronized Commerce.

Source: The Sequoia Partnership, Prologis

Note: Costs based on calculations by The Sequoia Partnership. See our end note 2 for more information on these calculations.

Considerable opportunity remains to increase service levels and manage costs. Historically, companies have focused on minimizing costs across individual pieces of the supply chain. Separate individuals procure real estate, transportation, labor, equipment, etc. However, optimizing each category does not necessarily optimize the full system. Naturally, leading national and international organizations have operated this way for some time. However, the differing time horizons upon which these capabilities are secured (with contracts ranging from daily, weekly, monthly, annually and in the case of real estate, many years) creates opportunities to continually re-optimize. Going forward, to remain competitive, companies will look to optimize costs and service levels across the entire supply chain.

Modernizing Supply Chains to Unlock Value and Create Opportunity

The expansion of e-commerce supply chains provides visibility into true end-to-end total cost to supply. Supply chains now stretch all the way to a consumer’s doorstep, offering convenience and selection. This represents the rise of Synchronized Commerce, whereby retailers perform the pick/pay/deliver portion of supply chains. The value proposition of e-commerce is that consumers no longer have to invest time to shop for goods, wait in line to pay and travel between stores and their homes. This shift has caused considerable change in the overall economics and distribution of costs. These changes are shown in the exhibit above and further detailed below:

- Total cost to supply, when considering both direct and imputed costs, is about 15-20% lower for e-commerce versus brick-and-mortar.

The shift from consumer time to professionalized transportation and work in distribution centers consolidates and scales these activities, making them more efficient.

- The rise of e-commerce causes considerable change at the consumption end of supply chains, transforming the retail, surface transportation from DCs, and distribution centers themselves, which collectively represent some 75% of direct supply chain costs.

- Under e-commerce, transportation and work in distribution centers experience the biggest increase (we estimate a 400% increase in spend), which has become considerably more important to manage as a result.

- These re-allocated costs are poised for future efficiency gains, as omni channel and dedicated e-fulfilment networks are still in their early stages as compared with more mature strategies for brick-and-mortar distribution.

- These shifts place greater importance on logistics real estate choices to raise service levels, reduce delivery times and transportation costs, and ensure adequate labor availability.

Logistics real estate is a key factor for success. Logistics real estate is the smallest cost among major cost categories of supply chains. It accounts for less than 5% of total cost to supply. With rent a small share of supply chain costs, real estate choices can create value far beyond their cost. Further, real estate choices are a lever to help control other costs. The ongoing emphasis on greater service levels is translating into users choosing infill and higher-rent real estate over lower-cost options. This value creation is driving the re-pricing of logistics space, particularly in markets and submarkets where rents are already high. Users are becoming increasingly willing to pay more in rent because the location creates more value. This is particularly true in dense urban areas because of the scarcity of close-in land. Looking ahead, logistics real estate rents will become more differentiated over time: commodity space will be priced based on development costs, infill Last Touch® will be priced based on delivered value.

Users of logistics real estate spend $10 on transportation and $5-$7 on labor for every $1 spent on rent.

Contrary to popular opinion, e-commerce creates jobs. Traditional analyses have focused only on the decline of retail employment but have missed the considerable growth in the logistics industry (and the acute labor shortage). Indeed, the lengthening of supply chains formalizes previously unorganized labor and creates jobs. Historically, consumers performed the pick/pay/deliver portion of supply chains. This “work” was self-performed, inefficient (e.g., neither coordinated nor at scale) and unrecognized as formal employment or economic activity. With the rise of e-commerce, retailers now perform the pick/pay/deliver portions of supply chains. Aggregating and scaling daily consumer efforts is a more efficient form of distribution and generates employment. These roles include technology jobs to power online shopping, order picking jobs to organize deliveries, and jobs in transportation to get goods to consumers.

Logistics Real Estate: Benefiting from Innovative New Forms of E-Commerce Delivery

The cost-competitiveness of decentralized distribution networks for e-commerce should continue to create more demand near consumers. Our analysis of network costs for e-commerce shows decentralized distribution to be more cost-competitive than centralized e-fulfilment operations. For centralized models, splitting orders into individual parcels far from consumers creates added transportation costs that outpace the additional inventory carry costs of geographically distributed distribution models. Our model estimates home delivery costs in a decentralized distribution network are about one-quarter that of a centralized distribution model. There is a natural tradeoff between the benefits of centralized inventory consolidation and transportation costs—as online concepts grow and reach scale, more companies will find regionalized e-fulfilment models to be appropriate. A strong regional and Last Touch® network also allows for faster deliveries.

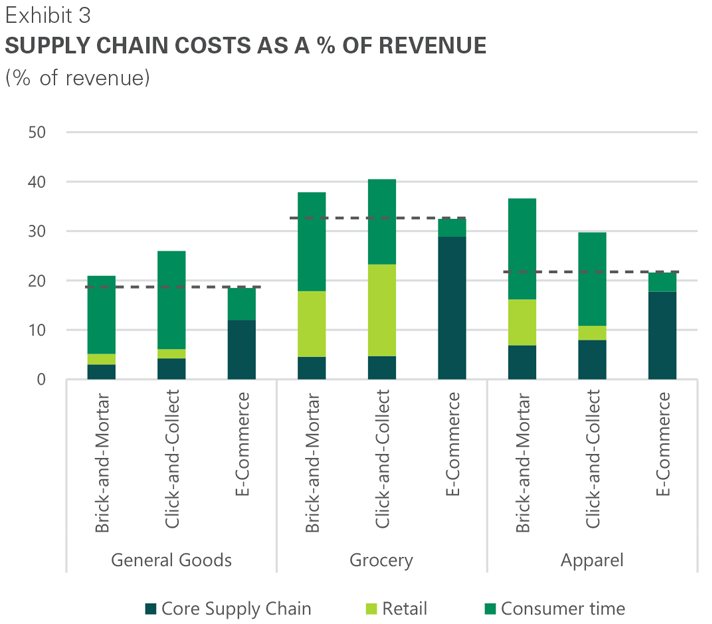

Experimental delivery models, such as click-and-collect and lockers/kiosks, boost logistics real estate demand. There is considerable innovation in e-commerce delivery, including click-and-collect (pick up in store) and lockers/kiosks. These strategies have gained market share in the world’s leading e-commerce markets such as Tokyo and London. Retailers have been experimenting with these methods for several years, although they are a small share of overall e-commerce deliveries. However, they are cost-competitive with both traditional brick-and-mortar distribution and traditional e-commerce fulfilment and could have staying power, as shown in the chart below.

Source: The Sequoia Partnership, Prologis

Note: Please see our end notes for important assumptions

These new models of e-fulfilment create logistics real estate demand in much the same way as traditional e-commerce delivery. Orders for both click-and-collect and kiosks/lockers are routinely filled from regional distribution centers, city distribution centers and Last Touch® facilities. Two key drivers that keep retailers from leveraging stores for fulfilment:

- Inventory knowledge and availability. Online ordering requires high confidence in inventory quantities to guarantee delivery at the order acceptance stage. This confidence does not exist in retail footprints; instead, the point where inventories are known with confidence is within supply chains in regional and city distribution centers.

- Appropriate location of singles picking. Singles picking operations that take place in retail stores put retailers in competition with customers for inventories. In addition, the fulfilment of orders from stores creates some redundant operations (e.g., from carton to single, then single to online order), adding costs.

Conclusion

For supply chains, the only constant is change. Our model of the economics of supply chains helps reveal the most durable industry trends. It also helps evaluate the tradeoffs supply chains must make amid rising service levels. The most relevant points for real estate owners and operators include:

- Current e-fulfilment network strategies are durable as they deliver superior consumer value and tap into the cost optimization potential of distribution networks.

- E-commerce intensifies the focus on distribution center location strategy. Relative to brick-and-mortar, e-fulfilment requires the re-allocation of 75 percent of supply chain costs and prompts an approximate 400 percent increase in spending on distribution centers and transportation to consumers.

- Decentralized e-fulfilment distribution is the most cost-effective model. Total cost of supply is about 15-20% less than self fulfilment in a traditional retail environment. These cost savings are amplified by higher service levels that provide a competitive advantage.

- New methods of e-fulfilment (e.g., click-and-collect) add to logistics demand in the same manner as traditional e-fulfilment, which is 2.5-3 times that of a pure brick-and-mortar retailer.

- Reconfigured supply chains are intensifying the need for labor and creating significant employment opportunities in local communities.

What might the future hold? This paper focuses on the current state of supply chains. Our next piece explores future trends. Technical innovation and economic cycles are leading to change among the constituent costs of supply chains, especially for transportation, labor and equipment. Innovations, such as alternative fuels, robotics and automation, and big data/predictive analytics will shape the future of supply chains and, potentially, the types of real estate most in demand.

ENDNOTES

1. For the purposes of a direct comparison as shown below, we assume consumer labor is valued at 50% of median income, or approximately $10/hour, which yields a significantly higher total cost to supply for brick-and-mortar of nearly 50% higher.

2. Costs shown based upon current market prices within general merchandise supply chains and are meant to approximate overall supply chain cost structures. Supply chains and our calculations are the product of decisions and assumptions. Highlights include network strategy such as points of origin and destination (e.g., from Shanghai to New Jersey and onwards to New York City); goods, carton and packaging dimensions for the purposes of sizing warehouse and transportation needs; consumer shopping habits such as goods per customer order and share of goods returned; and, relevant retail operating costs. Valuing consumer time requires assumptions too, such as shopping and travel time, order quantities (e.g., number of products bought per trip) and the wage at which consumers value their time.