Our last paper explored the structural trends driving demand for prime logistics space. Given that demand will remain strong in the foreseeable future, our focus now turns to the implications for new supply.

The transformation of logistics real estate development has followed a compelling trajectory. Clear insight into the structural forces that shape supply trends allows customers to better navigate scarcity and prepare for demand-side shifts.

We expect completions to fall short of demand in most locations over the next decade. Changes that will continue to impact new supply include:

- Significant barriers to new supply are pushing it farther from existing supply. These barriers include:

- Geographic – land that can accommodate future-proofed buildings is scarce, particularly in the largest consumption centers.

- Economic – replacement costs continue to trend upward as urbanization drives competition among real estate providers.

- Political – the permitting and entitlement process is more difficult, expensive and time-consuming than ever, increasing cost and decreasing potential supply.

- Building requirements are increasing. Today’s buildings can advance operational efficiency through location, functionality and sustainability. While location is paramount, the latest labor- and technology-friendly features can support productivity but also increase construction costs. New restrictions and regulations are adding risk to development in some locations. Buildings that incorporate sustainability features can help users and owners adapt to regulatory shifts. At the same time, obsolescence effectively reduces the amount of competitive supply and drives the need for development of replacement facilities.

- Differentiation among properties is widening. Together, these trends have reduced user’s price sensitivity for buildings that are well-located or which incorporate the latest building design features, leading rents higher. Demand-side shifts should extend this trend as:

- Growing e-fulfilment and rapid replenishment needs elevate demand close to urban cores, where logistics real estate is increasingly scarce.

- The evolution of future-proofed buildings limits new supply as construction costs escalate and obsolescence adds to demand for Class A space.

Barriers to supply are significant and rising

The supply of well-located industrial land is decreasing.

Industrial-zoned land is shrinking in most densely populated areas due to conversions to other uses. For example, between 2013 and 2020 in the city of San Francisco, 362 permit applications were for a conversion from logistics to another use versus 57 from another use to logistics.1 Buildings have gotten larger and need more yard space per building square foot, as the primary function of a warehouse has changed from product storage to flow-through, making it even more difficult to find a suitable parcel. In the U.S., buildings constructed in 2000 or later are 55% bigger and require 66% more land on average than those built in the 1980s and 1990s.2 Compounding this challenge, logistics sites need access to adequate infrastructure.

New supply is farther than ever from consumption centers and existing properties.

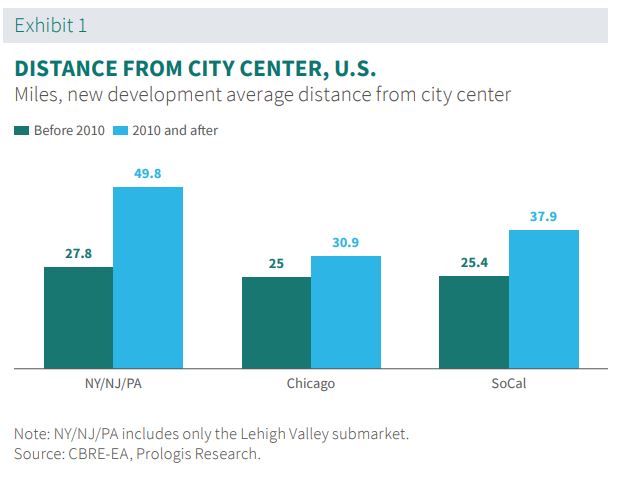

A lack of land availability, regulatory restrictions and population expansion outwards from urban centers has pushed new logistics supply farther from existing supply. The outlying submarkets of major markets are currently being tested due to a lack of land in established submarkets for logistics space and/or labor shortages. For example, in the Greater New York City region, logistics properties built before 2010 were on average 28 miles from Manhattan but, post-2010, are now 50 miles away. Chicago and Southern California exhibit similar trends, increasing from 25 miles on average each to 31 to 38 miles, respectively.3

This distance can create a challenge for users looking to meet consumers’ expectations for fast delivery. Transportation costs also factor in; transportation comprises roughly 50% of supply chain costs compared with just 5% for logistics real estate.4 The growing distance of logistics space from city centers insulates existing properties from new supply and can lead to a meaningful location premium, particularly as Last Touch® delivery needs expand. This is a stark difference between logistics and other property types such as downtown office and multifamily, where new supply is often in direct competition with existing supply.

Conversions (such as retail-to-logistics) will not meaningfully increase new supply.

While some retail owners are exploring conversions to distribution facilities, Prologis Research expects that successful conversions will be limited for the following reasons:

- Economic, including higher and better use cases such as apartments; and, high costs relative to locally competitive alternative logistics submarkets.

- Political, including restrictive zoning and entitlements; community opposition; and downzoning concerns including a perceived loss of sales tax revenue.

- Physical, including poor reconfigurability of existing structures; inefficient site layouts/geometry; and sites that are too small for logistics uses.

- Legal, including reciprocal easement agreements (REAs); co-tenancy limitations; and multi-party negotiations that prevent or elongate redevelopment to logistics.

Prologis Research estimates a total of 50-100 MSF of retail to be converted to logistics space over the next decade in the U.S., representing less than 3% of a typical year for new logistics supply.5 More detail can be found in our prior study.

Rising land and construction costs add economic hurdles to logistics real estate development.

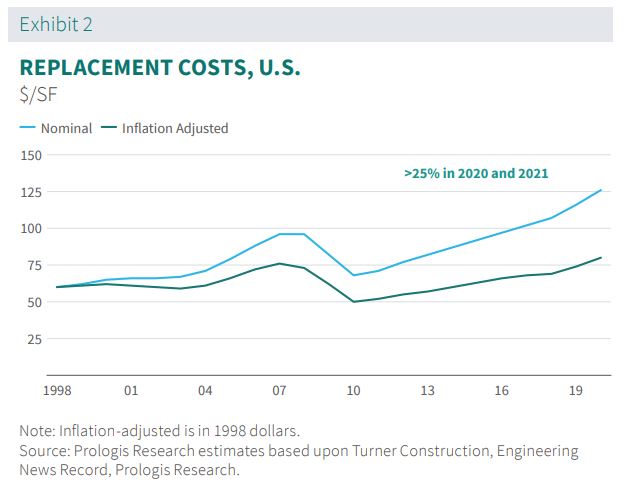

Replacement costs have outpaced inflation in the last decade, driven by growth in land prices, materials and labor. Land cost escalation is especially sharp in coastal markets and the inner submarkets of densely populated metros, which have high barriers to new supply. Land costs tripled in Toronto over the past ten years, with price escalation of 140% in the last five years compared with 35% nationally.6 Land prices increased by 475% in the same period in the Port/Meadowlands submarket of New Jersey, which is located across the Hudson River from New York City.7

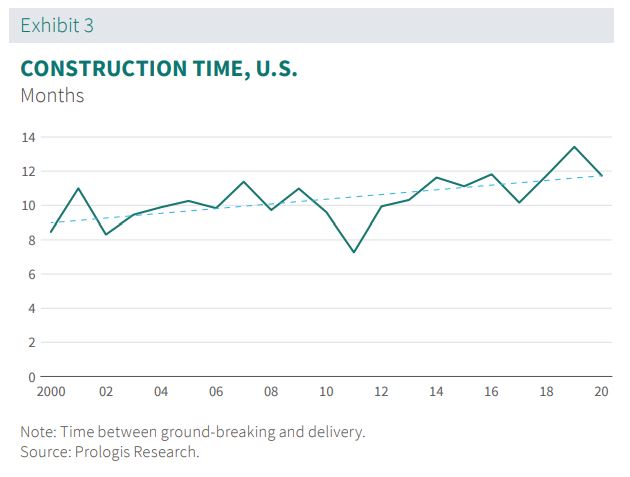

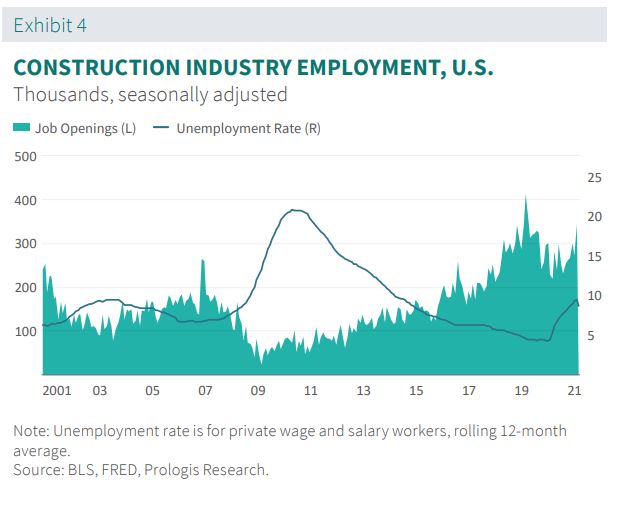

Materials costs have been growing steadily albeit more slowly; however, this has changed as a result of post-pandemic supply chain bottlenecks and surging demand, which in turn prompted rapid escalation. Steel prices in the United States tripled in the last year and doubled in Europe, China and Brazil.8 In addition, wages have increased and remained elevated, in part due to the shortage of construction labor that has persisted for several years. General contractor pricing has increased alongside demand. The time between breaking ground and completion has expanded by two to three months, or 20%, over the past decade, adding to costs.9 Prologis Research estimates nearly 60% growth in replacement costs over the past five years, including 15% in 2021 alone.10

Regulatory environment is harder to navigate.

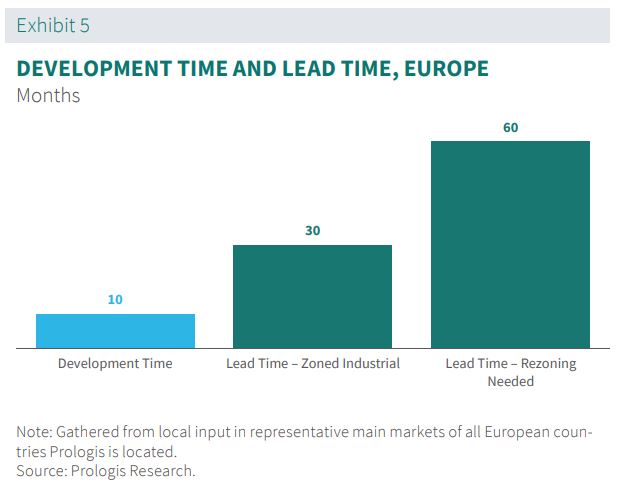

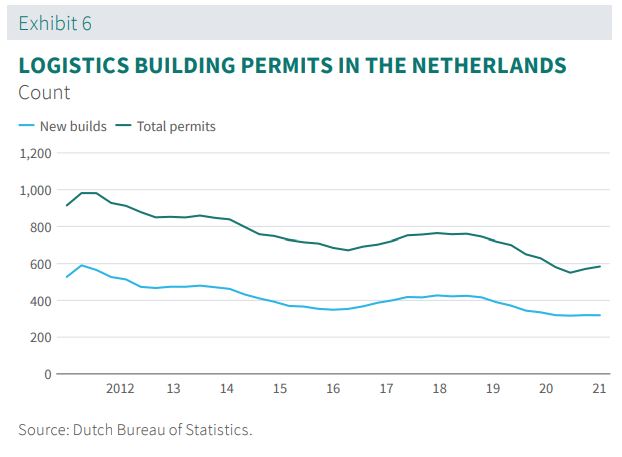

Regulatory barriers to new logistics development are increasing across the globe, extending development lead times. For example, logistics permits in the Netherlands have fallen by more than 30% in nine years.11 At the same time, the pandemic has highlighted the critical role of logistics in the functioning of society. Compounding this trend, a lack of municipal resources and increased environmental requirements have added to lead times. In the European Union, development lead times for projects that need rezoning are roughly double that of projects already located in industrial zoned land12 with a similar trajectory in major U.S. markets.

Building requirements and costs are increasing

Location selection

The importance of site selection is slowing functional obsolescence near end consumers.

Driven by the rise of e-commerce, the need to be close to end consumers has become mission-critical and should continue to intensify going forward. As delivery times decrease, companies must reach consumers via shorter distances, necessitating built-out networks even within a single metropolitan area, thereby opening up new locations for this purpose. For Last Touch® operations, building functionality is a secondary concern to location, and less modern buildings can be in high demand. This shift has increased the value of even less-functional logistics facilities in areas proximate to end consumers.

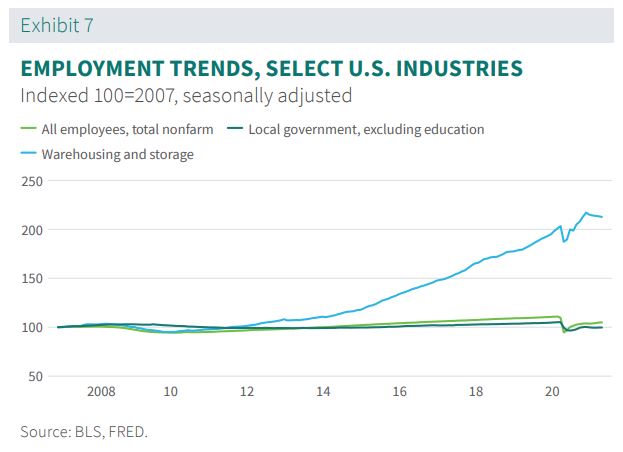

A lack of logistics talent can constrain development in land-rich areas.

For logistics users, labor scarcity is worsening for three reasons. First, e-fulfillment is expanding, which uses roughly 3x the labor of a traditional warehouse operations, with turnover rates around 4x that of other uses.13 Second, complex warehouse functions and technologies require more skilled labor; for example, engineers for automated warehouse solutions. Finally, densely populated submarkets that offer deep and skilled labor pools generally have scarce land availability for logistics use. With land more available in less densely populated areas, clustering of logistics facilities can exhaust the supply of labor and limit the feasibility of further new supply.

Functionality

Buildings need to be labor-friendly.

Increased value-add services in logistics facilities have made labor a valuable, yet scarce, asset. A healthy and sustainable work environment can give employers an advantage in attracting and retaining talent. Accelerated by the pandemic, facility improvements that focus on worker well-being, such as the WELL standard, are becoming popular. This certification brings together stringent requirements in areas such as indoor air quality, water quality, natural light and thermal comfort, as well as nutrition, physical activity facilities and mental health. These amenities can improve operational productivity and cost control for customers and are a competitive differentiator.

Building design features need to accommodate new technologies.

It is important to develop buildings with leading-edge technologies in mind. As noted in our automation series, this allows logistics users to optimize their facilities, and it opens up newer and more productive locations close to the end consumer. Most modern facilities meet the requirements for flexible automation, but certain features can be added to make them even more automation-friendly. Increased power capacity, extra space for recharging mobile technologies, access to high-speed data, flooring quality, strong roofing and increased clear height can collectively accommodate technologies used to augment labor needs, increase operational visibility and manage risk. These investments promote greater value creation within the four walls of the building. Further, buildings that can more readily accommodate automation can unlock better locations where labor costs and availability have been hurdles, such as urban cores for Last Touch® delivery.

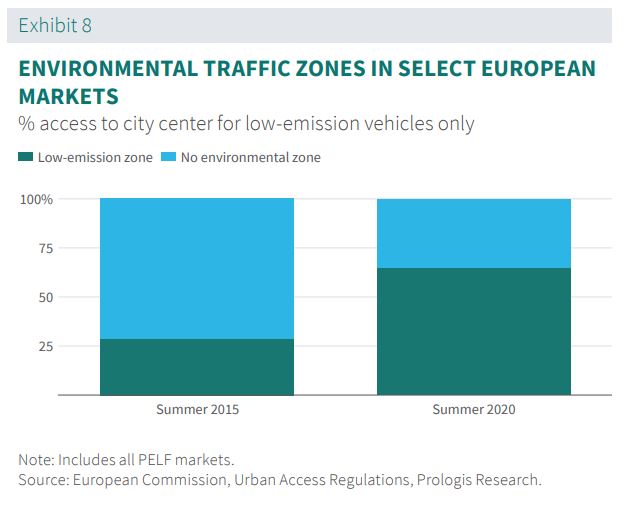

ESG features add proven value.

A synchronized rise in the importance of sustainability from consumers, customers and capital sources is increasing the need to incorporate sustainable practices into supply chains. The ability to advance sustainability goals is an emerging differentiator for logistics properties. Features can include access to solar and other renewable energy sources, energy-efficient lighting, EV charging facilities and sustainability certification.

Differentiation among properties is widening.

This differentiation occurs on two of the same vectors as obsolescence: locational and functional. For e-fulfillment and rapid replenishment operations, local is paramount. Properties close to end consumers tend to be older and less functional but offer increasing revenue generation benefits as service level expectations rise. At the same time, obsolescence is adding to the need for replacement properties. For High-Through-Put DistributionTM operations, logistics real estate property features can improve productivity and control costs. The rapid evolution of consumer habits, labor needs and technology are better than ever and have increased the benefits of securing properties best-suited to house the supply chains of the future, while scarcity has increased occupancy and rents across a broad range of logistics properties.

Scarcity is likely to persist in many locations, as existing well-located properties are insulated from new supply, barriers to supply rise further and future-proofed buildings require premium rental rates to compensate for increasing replacement costs. While rising value in well-located and well-designed buildings will justify more creative real estate solutions, such as multistory facilities in new markets or conversions from other use types, the structural shifts in the logistics real estate development industry will likely continue to limit the amount of new supply delivered to meet users’ future supply chain needs.

Endnotes

1. San Francisco Department of Building Inspection via OpenDataSF accessed on June 3, 2021.

2. Prologis Research.

3. CBRE-EA, Prologis Research.

4. A.T. Kearney, Prologis Research.

5. Prologis Research.

6. CBRE, Prologis Research.

7. Cushman & Wakefield, Prologis Research.

8. https://www.spglobal.com/platts/en/market-insights/blogs/metals/042721-global-steel-price-rally-iron-ore-iodex-all-time-high-china-stimulus.

9. Prologis Research.

10. Prologis Research.

11. Dutch Bureau of Statistics.

12. European Commission, Urban Access Regulations, Prologis Research.

13. Prologis Research, company public filings.

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of March 31, 2021, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 990 million square feet (92 million square meters) in 19 countries.

Prologis leases modern logistics facilities to a diverse base of approximately 5,500 customers across two major categories: business-to-business and retail/online fulfilment.