IT’S THE TIME OF YEAR FOR BOLD PREDICTIONS!

Prologis Research tapped into decades of industry experience, proprietary data, and unique property and customer insights to predict seven trends for 2024.

- The global freight recession will reverse, demonstrated by double-digit growth in port and truck traffic.

- The great construction bust will intensify, with global starts hitting the lowest level since the 2008 financial crisis.

- Latin America rents will grow at more than double the global average, driven in part by nearshoring.

- Annual demand in China will reach the second-highest level on record, helping work through excess supply from the past few years.

- Technology, especially artificial intelligence, will drive up energy requirements in logistics facilities, incentivizing warehouse owners to double solar capacity.

- Interest rate declines will double private equity real estate funding in 2024. (We’re taking a bull case on interest rate cuts.)

- Cap rate movements will reverse. U.S. and European cap rates will compress while expansion rotates to Asia.

In reviewing our bold predictions for 2023, key themes played out. Development moderated from tightening regulatory landscapes, cap rate expansion and high construction costs. Nearshoring and sustainability requirements met the upswing we anticipated. E-commerce recovered, although it did not translate to leasing outperformance.

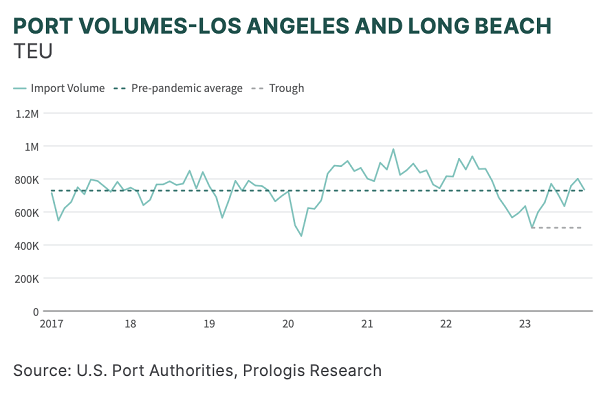

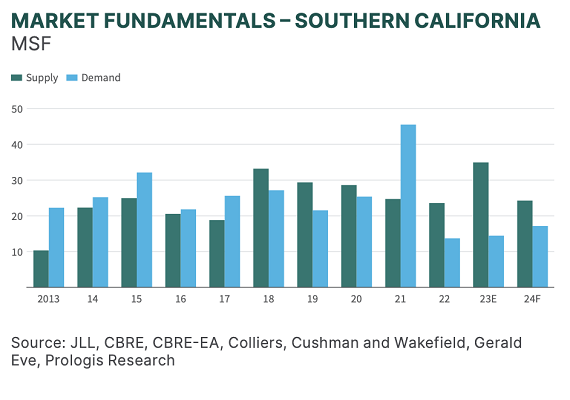

1. The global freight recession will reverse, as demonstrated by double-digit growth in port and truck traffic. The Southern California region is likely to be among the first to benefit.

- Import volume at Los Angeles and Long Beach ports will exceed pre-pandemic levels. Combined, the ports saw a 46% resurgence in imports since the trough in February 2023, as temporary factors such as ILWU contract negotiations and the post- pandemic bullwhip effect faded as anticipated.

- Southern California logistics real estate demand will rank in the top 5 U.S. markets, reaching the highest level since 2021.

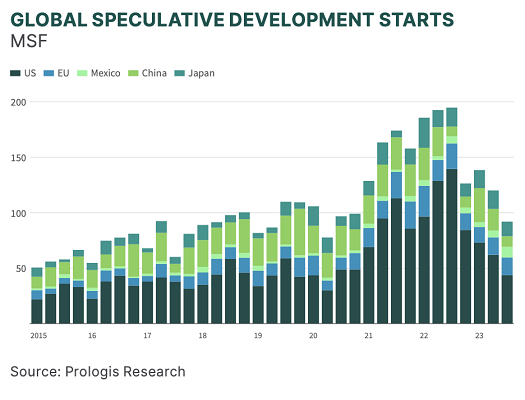

2. The great construction bust will intensify, with global starts hitting the lowest level since the 2008 financial crisis.

- Construction costs rose by 5-10% during 2023 in most geographies, with an exception in Europe.

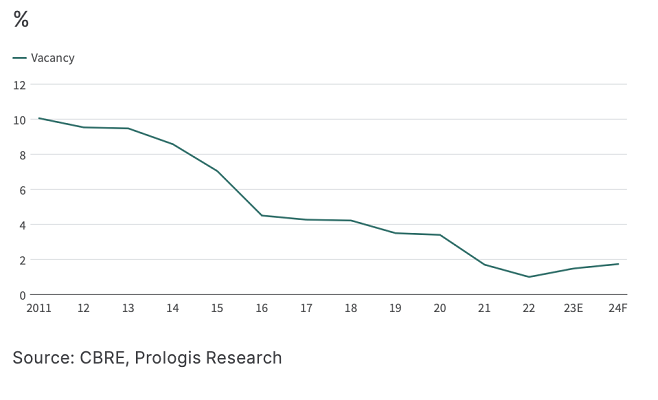

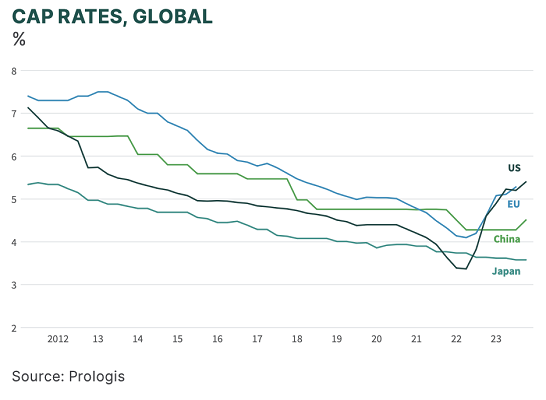

- With cap rates expanding globally, up roughly 200bps in the U.S. and roughly 150bps in Europe, a reduction in development margins curtailed development starts. In 2023, spec development starts are down 65% y/y in the U.S. and more than 50% globally.

- Investments in manufacturing and infrastructure and a stabilizing housing market supported demand for construction materials, buttressing commodity prices. At the same time, labor markets remained tight, adding to cost pressures.

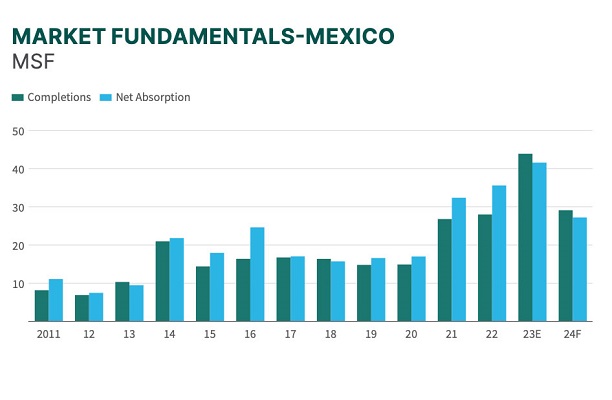

3. Latin America will continue to see rent growth at roughly double the global average, driven in part by nearshoring.

- Record-high demand in Latin America will continue into 2024, especially in Mexico as nearshored manufacturing capacity comes online.

- However, vacancy rates are below 2% in Mexico and forecasted to remain tight throughout 2024, meaning customers will have to compete for limited space. Supply constraints include access to sufficient power, especially for new manufacturing- related requirements, as well as permitting. In Brazil, we forecast mid-single-digit vacancies by 2025. Rents have risen to match construction costs in both countries, with rapidly increasing land values exacerbating the issue in both Mexico and Brazil.

4. Annual demand in China will reach the second- highest level on record, helping work through excess supply from the past few years.

- Unusual crosscurrents have held back China’s logistics real estate market performance:

- COVID-19 restrictions that disrupted business decision-making and damaged consumer confidence;

- Restrictive policy decisions in the tech and property sectors;

- Reassessment of manufacturing locations; and

- A global economic downcycle just as mobility restrictions were lifted.

- As a result, demand stagnated in 2022 and 2023.

- Fiscal and monetary policy will further ease in 2024, providing demand- and supply-side incentives to emerging technologies, such as new energy vehicles (NEVs) and charging stations, renewable energy and chipmaking capabilities. E-commerce growth, which slowed to 8% y/y through October 2023, will reaccelerate to 10% or more in 2024.1

5. Technology, especially artificial intelligence, will drive up energy requirements in logistics facilities, incentivizing warehouse owners to double solar capacity.

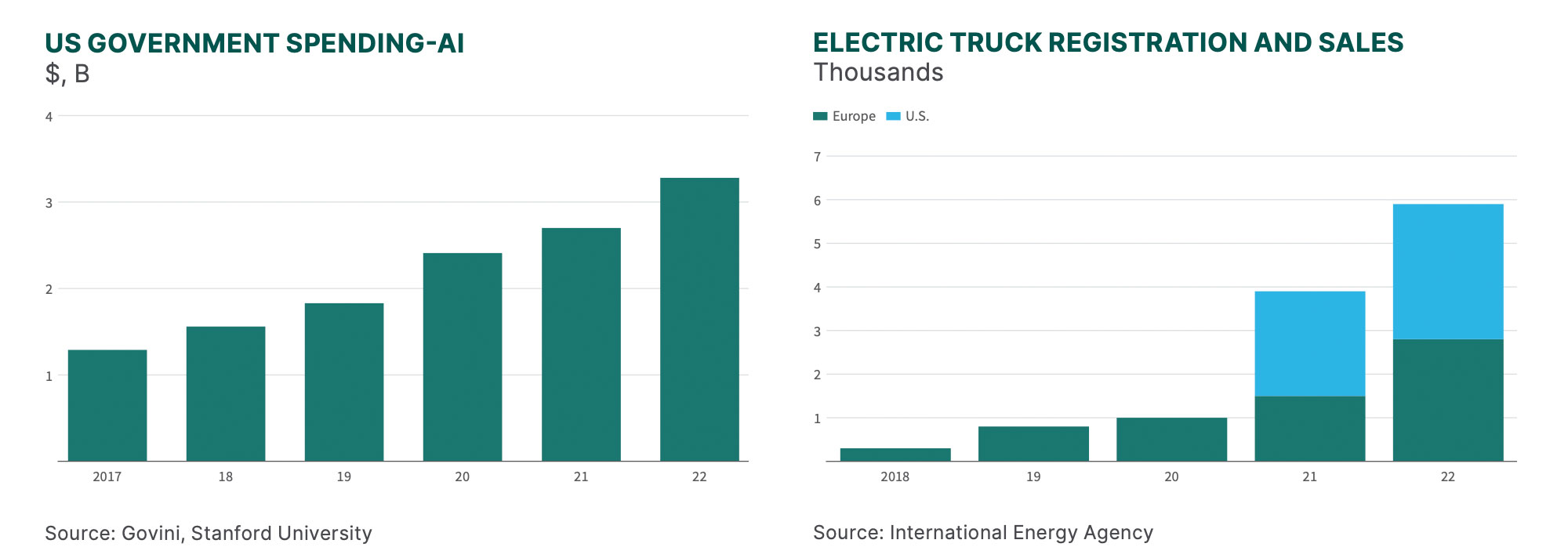

- Spending on AI research and development is on a secular rise. In the U.S., government AI expenditures alone grew 21% y/y in 2022.2Derivative data center requirements will increase energy needs.

- At the same time, automation solutions will grow. We expect half of warehouses to utilize autonomous mobile robots in the next decade and 10-20% adoption of automated storage/retrieval systems in the next 10-15 years.

- Electric vehicle (EV) charging needs are rising. While China leads the deployment of electric trucks, adoption has broadened in Europe and the U.S., particularly in the last two years.3

- Solar energy is key for sustainable power generation. Costs are economically feasible, and government incentives can fast-track adoption. In addition, supply chain issues are unlikely to continue to restrain solar installations in 2024.

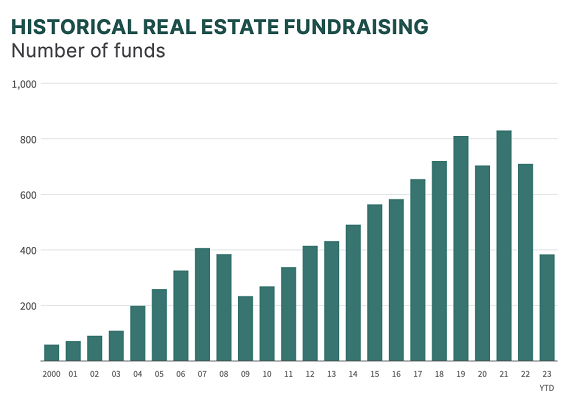

6. Interest rate declines will double private equity real estate funding in 2024.

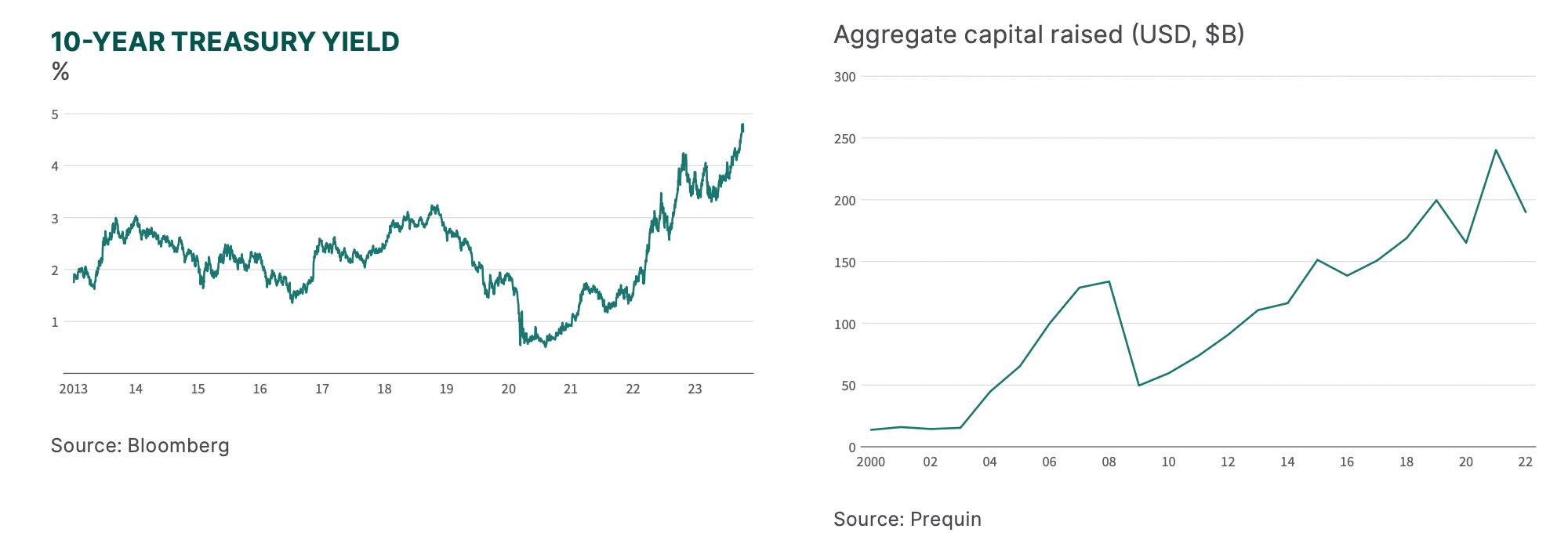

- Our projections take the bull case on interest rate cuts. While the latest Federal Open Market Committee member projections from December show a median federal funds rate in 2024 in the mid-4% range, lower than 2023’s mid-5% range, we expect inflation to slow more quickly than anticipated.

- We expect the U.S. 10-year Treasury yield to dip below 4% in 2024, ahead of consensus views for around 4%.4

- Institutional dry powder is waiting on the sidelines, and interest rate declines in the second half of the year will unlock entry into the market as the capital markets cycle begins to turn.

7. Cap rate movements will reverse. U.S. and European cap rates will compress while the expansion rotates to Asia.

- Yield spreads between Western and Asian markets widened from a low of minus 50 bps in early 2022 to 130 bps in Q3 2023, higher than the 2019 average of 30 bps.

- Per our prediction #6 above, the cost of capital is expected to decline in the U.S. and Europe and rise in Japan as monetary policy tightens in the latter. In China, required premiums should grow to match perceived geopolitical risks alongside uncertainties in operating fundamentals due to high supply.

CONCLUSION

These predictions are based on insights from our unique platform, and we’ll revisit them at year-end. Our outlook highlights 2024 as a year of healthy demand growth, constrained supply, technological evolution of logistics facilities and a turning of the capital markets cycle.

WHAT DID WE GET RIGHT AND WRONG IN 2023?

✓ X U.S. warehouse development starts will drop to a seven-year low, even as rent growth exceeds 10%.

U.S. starts fell 48% y/y to 263 MSF, the lowest level since 2020.

The full-year rent growth estimate is 7% for the U.S as of Q3 2023.

✓ California’s barriers to development will permanently constrain logistics demand, allowing Texas to become the #1 state for net absorption.

Texas markets recorded 60 MSF in net absorption in the four quarters trailing Q3 2023, the highest of all U.S. states.5

✓ Mexico demand will hit a new annual record as nearshoring drives expansion along the border.

Mexico’s main six markets absorbed an estimated 41 MSF in 2023, 8% higher than the prior high in 2022.6

X India will rise from fourth to the third-most-active country for development starts, behind the U.S. and China.

We estimate India’s main eight markets recorded fewer starts than Japan, where starts pulled back but remained elevated at 57 MSF in 2023, behind China (90 MSF) and the U.S. (263 MSF).7

✓ Build-to-suit rents will reach new levels in the U.S. and Europe as market rents are capitalized at 5%, despite falling land and construction costs.

Construction costs and cap rate expansion combined as expected, driving up replacement cost rents and slowing build-to-suit starts, by 38% from the prior three years.

X E-commerce leasing will bounce back to become the second-most-active year on record (after 2021).

E-commerce sales growth recovered and outperformed in 2023, rising by 8% year to date in the U.S.

E-commerce leasing, however, remained moderate.

✓ Demand for sustainable warehouses will grow rapidly. Installed rooftop solar capacity will double, and EV truck charging capacity will exceed 10 megawatts.

Solar capacity grew 50% in 2023 but was held back by supply chain issues.

More than 10 megawatts of EV truck charging was installed in Southern California alone in 2023.

END NOTES

Source: National Bureau of Statistics, Prologis Research forecast.

Source: Govini, Stanford University.

Source: International Energy Agency.

Source: Consensus Economics, December.

Source: CBRE, C&W, JLL and CoStar, for markets wherein Prologis operates.

Source: CBRE, Prologis Research estimates.

Source: Prologis Research estimates based on JLL data.